Investing in the lucky country

“The lucky country” is a statement that has been used to describe Australia on many different levels over the years.

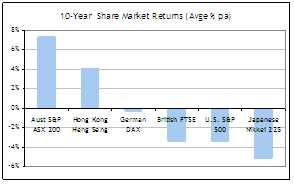

For investors around the world, the last 2 years have been a particularly tough time. However, over the longer-term Australian investors have been amongst the luckiest, with the local share market out performing most. The chart below shows 10-year average annual returns for major international markets. From this chart we can see that overseas investors have been doing it a lot tougher, for a lot longer, than those with their portfolios skewed towards the Australian market.

Source: van Eyk Research. 10 years to 31 May 2009

Home country bias

Despite the Australian share market representing just 2% of the total global market in terms of value, many Australian based investors hold at least half of their equity investments in Australia, and there are some logical reasons for this apparent home country bias:

- Various studies have shown that the franking credits paid with dividends are not fully valued into market prices and therefore Australian tax paying investors receive a benefit not available from non Australian equity markets.

- Investing in the home country can normally be done slightly more cheaply than investing abroad and doesn’t carry the same currency risks or management costs.

- Investors tend to have a greater degree of comfort investing in companies in which they have a degree of familiarity. The local supervision and governance structure provides another source of support and confidence around investing locally.

Hence, if the Australian share market was only to perform in line with international markets over the longer term, there is still a solid rationale as to why Australians would skew their investments locally.

As shown in the chart above, any local bias in an Australian investors’ portfolio is likely to have delivered a bonus that has been over and above the original rationale for holding a home country bias.

Australia has delivered

If it is believed that the Australian share market is no less risky than other developed country share markets, then it should follow that over the long-term real returns from the Australian share market will equate to those available overseas. This is because market forces would ensure that share prices are set at a level that provides equal returns across markets. If there was an expectation that one particular market was to generate a higher risk adjusted real return, then the flow of investment funds into that market would bid prices up to a level that meant future expected returns became equal across markets.

Hence, for a geographical market to provide ongoing superior risk adjusted returns, the performance of that market’s companies must surprise or out perform market expectations on an ongoing basis. Over the past decade, a commodities boom, the relatively low exposure to the “tech wreck” and the sub-prime loan crisis are all unexpected events that have worked in Australia’s favour and may explain some of the superior share market performance.

Looking beyond these more recent events, the data still suggests an underlying out performance from the Australian market. Between January 1971 and May 2009, the average real (after inflation) return produced by the Australian equity market was 8.6% per annum. This is 1.6% per annum above the average return produced by the international equities asset class a whole.

Australia’s ability to “punch above its weight” on the sporting field is well renowned, however the corporate sector has also produced an impressive track record over the years – perhaps at least partly explaining the superior share market results. Over past decades Australia’s corporate sector has been instrumental in the development of the world’s largest mining company in BHP Billiton; the worlds’s largest shopping centre manager in Westfields; one of the world’s largest media empires in News Corp; and it could now be argued to have the world’s most robust banking system.

The relative outlook remains favourable

Recent economic data suggests that the Australian economy as a whole has performed better than expected so far through the Global Financial Crisis. This economic performance, combined with a the fact that Australia’s banking system remains intact, provides some promise that our equity market can continue to perform well relative to international benchmarks.