Key points

- Australian shares have moved from being undervalued to around fair value, but despite strong gains they are a long way from being in a bubble.

- While shares are currently at risk of a correction, we see more upside on a six to 12 month view on the back of solid earnings and very strong share demand.

The relentless rise in the Australian share market

With the Australian share market continuing to surge upward, it is reasonable to question its sustainability. Is the share market overvalued? Is there a bubble? How far can it go?

Not as cheap as it was but still not a bubble

Share bubbles are characterised by stretched valuations, investor euphoria, a lot of capital raising and a narrowing in share market gains. While there are some signs a bubble may be developing, our assessment is that Australian shares are still a long way from being in a bubble. Firstly, Australian shares are still not overvalued. After spending years tracking below our fair value estimate, the Australian share market has now pushed towards the middle of the fair value range. But while the market is no longer cheap, neither is it expensive.

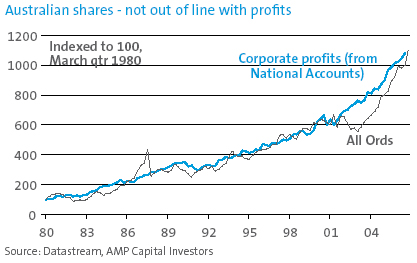

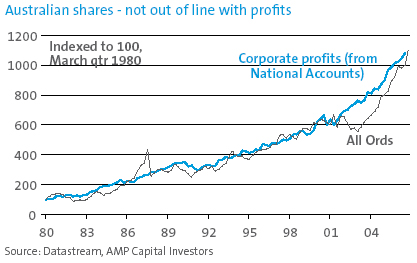

Australian shares have spent the period since the March 2003 bear market low catching up to the level of profits. For example, over the last year the share market rose 17%, but earnings per share rose correspondingly. This contrasts with the situation in 1987 when shares jumped 90% in 12 months to their peak, but earnings growth was 25%.

Australian shares’ high dividend yield underpins the market. The dividend yield, gross of franking credits at around 4.9% is only 1% below the 10-year bond yield and well above the gross yield on rental housing of around 3.2%, so it doesn’t take much capital growth to ensure shares have a decent return versus other assets.

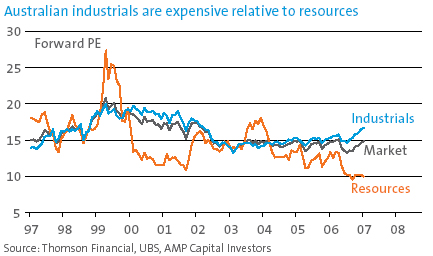

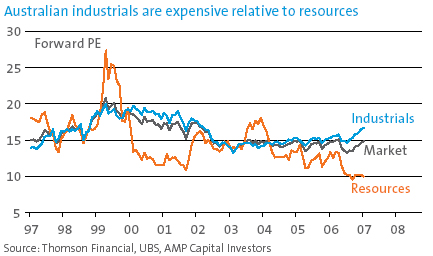

At 15.2 times, the forward price earnings ratio (calculated using year ahead forward earnings) is in line with its ten year average. However, it remains well below its late 1990s high of 18.3 times. Some argue that whilst the overall market may appear fine, this is due to cheap valuations for resources masking expensive industrials which have been bid up by takeover activity. However, all this says is that resources are cheap and the mismatch could be corrected by a rotation back towards resources at some point.

Similarly it is often argued Australian shares are expensive versus global shares because they are trading at a similar forward PE to global shares compared to a discount in the 1990s. However, with Australian shares generating better earnings growth with lower risk than global shares over the last decade, there is no reason for them to be trading at a discount.

The following table indicates that despite the huge gains over the last few years the Australian share market remains in far better shape than was the case prior to the 1987 share market crash or compared to US shares just prior to the start of the “tech wreck”. Specifically: capital growth has been more modest and in line with profits; PE’s are far lower; earnings yields are above the bond yield; and the real dividend yield is positive.

Investors are still not euphoric

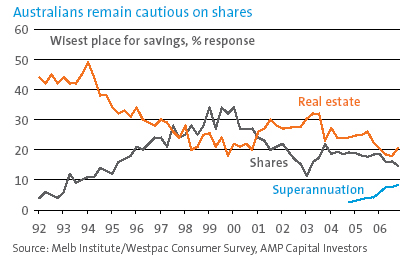

Secondly, while inflows into equity investment funds are up, we haven’t seen the euphoria that normally accompanies bubbles. The proportion of consumers nominating shares as the wisest place for savings is still below peak 2000 levels. See the chart below.

Thirdly, while capital raisings have picked up, relative to market capitalisation this is not excessive as is usually the case in share market bubbles. Excluding Telstra, net equity issuance (IPOs + secondary capital raisings less buybacks) amounted to 3.3% of share market capitalisation last year, which is in the same range as the previous four years, but well below 1997 and 1998 levels.

Finally, over the last year most sectors of the share market have seen solid gains, in contrast to the final stages of most share bubbles, which are usually characterised by a narrowing in investor interest, down to a few sectors/stocks. Certainly we haven’t seen the widening in PE dispersion that is normally seen at market tops with some shares trading on exorbitant PEs and others on very low PEs. Broad based gains are a sign of market health.

But could a bubble be developing?

A year ago there was concern that excitement over China was flowing over into a bubble in resources shares. This seems to have been forgotten with bubble worries shifting to private equity driven M&A deals in industrials. There is certainly a risk that the “weight of money” may now drive share prices beyond fundamentally justified levels:

- M&A activity is likely to remain strong given the low cost of capital, strong earnings, low corporate gearing and cashed up companies & private equity funds. In fact many of last year’s deals are still pending, eg, Qantas and Rinker. This will further reduce the supply of shares on issue & give cash back to investors for reinvestment in other stocks – possibly to the tune of $20bn, conservatively, compared to about $7bn last year.

- Superannuation inflows are likely to remain strong on the back of solid employment and wages growth and recent super reforms. Total demand for Australian shares from super flows could be $3-4bn higher this year than in 2006.

- The investment of Future Fund assets could see an additional $7-15bn flowing into local shares this year.

- Against this, net capital raisings are likely to fall slightly from last year’s level which was elevated by Telstra – particularly once BHP’s share buyback is allowed for.

The demand for shares is likely to remain high relative to supply, which suggests share prices are likely to rise faster than profit growth. The “weight of money” clearly has the potential to make the market more risky if it drives share prices away from fundamentals and as the LBO phenomenon leads to increased corporate gearing. But with overall market valuations still reasonable (particularly if there is a rotation back to resources) there may be much further to go in a world of relatively low inflation, low interest rates and excess savings. As a rough guide, if the market were to rise to the past peak in the forward PE in 1999 (ie, 18.3 times) this would suggest a rise to around 7200 for the ASX 200. This estimate will rise with earnings.

Conclusion

After very strong gains since the last correction low in June last year, the Australian share market is due for a short term correction. However, our assessment remains that Australian shares are not in a bubble and that further gains lie ahead over the next six to 12 months. Overall valuations are fair, the dividend yield remains attractive compared to other investments, profit growth over the year ahead is likely to be solid at around 10% and investors are not euphoric as is usually the case at major market tops. However, there is a “risk” that a bubble may be developing on the back of a huge imbalance in the demand for Australian shares relative to their supply. However, it is early days yet and so investors should hang on to their hats as the share market may have much further to run.

Dr Shane Oliver

Chief Economist and Head of Investment Strategy

AMP Capital Investors