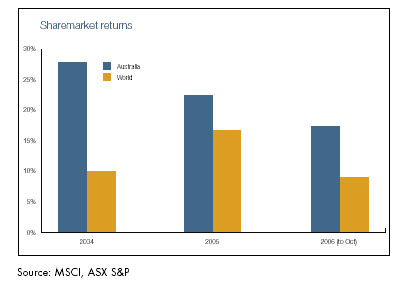

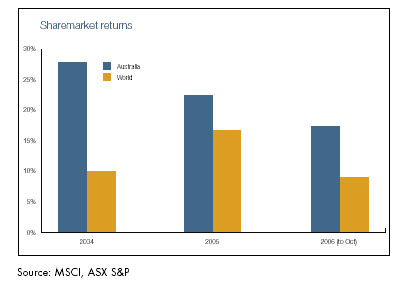

Over the past 3 years, there have been few better places for an investor than the Australian equity market. Buoyant economic growth and booming commodity prices have provided an environment ripe for corporate profit growth and this has been passed onto shareholder in spades. In the 3 years to October 2006, Australian sharemarket investors have received an overall average increase in wealth of 90%. The ride has also been very smooth with only 8 out of the past 36 months resulting in negative returns.

Although still producing solid returns, overseas sharemarkets have not produced the same level of returns as the Australian market, with the average international share portfolio generating a total growth of 43% for the investors over the past 3 years. In addition, international shares may have caused investors slightly more angst over this period with monthly returns being negative on 12 occasions over this period.

Over the longer-term though, history suggests that pre-tax international and Australian sharemarket returns should not be too different. However, there is little evidence to suggest that the gap in returns will narrow in the current cycle. In the 2006 calendar year, the Australian sharemarket has added 17% to investor returns, whilst international markets are 9% higher on average.

Positive improvements in international economies

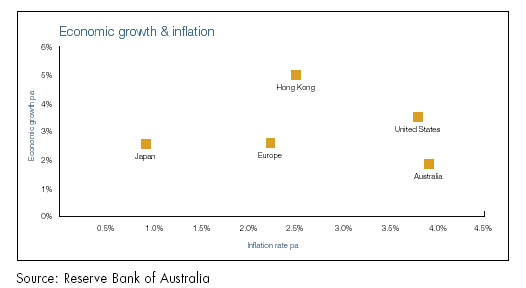

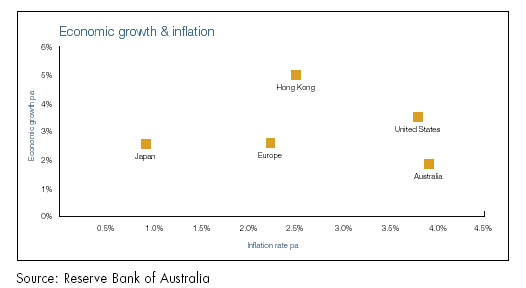

Economic fundamentals, though, do suggest that the position of overseas markets should improve relative to Australia. After lagging for some time, economic growth in most major world economies is now above that of Australia. And, as the chart below suggests, this superior economic growth is being achieved with inflation rates below that are currently prevailing in Australia.

As recent experience in Australia has verified, sharemarkets respond well to periods of strong economic growth and low inflation. Achieving economic growth without too much inflation ensures central banks are not forced raise interest rates to a level that would curtail additional economic growth. The maintenance of low inflation and low interest rates also keeps share markets and dividend yields attractive to investors relative to interest bearing investments.

Therefore, if economic fundamentals are anything to go by, the environment is currently more favourable for international rather than domestic based corporations. This could be translated into a superior overseas sharemarket performance – which would be long overdue.

By Brad Matthews, Hillross Economist