How strong will the economic recovery be?

Key points

- The improvement in economic indicators is consistent with an economic recovery by year-end.

- Tight credit markets and deleveraging will most likely result in a slow recovery initially. However, the severity of the global recession and the amount of stimulus means a ‘V-shaped’ recovery cannot be ruled out.

- After strong gains, shares are at risk of a correction and increased volatility in the months ahead as investors start to fret about the strength of the recovery. However, we expect the broad trend to remain up.

Shares at a fork in the road?

Economic data has improved over the last two months. Fears of a continuing collapse in global economic activity have now been largely unwound and this has seen shares deliver strong gains. However, it’s possible that the easy gains are behind us. The focus is now likely to be on the timing of the economic recovery and how strong it will be.

Timing the recovery

Share markets typically bottom about six months before the economic cycle. Thus, if economic growth is going to bottom and start turning higher from later this year, as we think it will, then it would be consistent with shares having bottomed during the first half of this year. In other words, it’s likely the lows in March were it for the bear market. Alternatively, if the recovery is going to be another 12 months or so away then the risk of a new low in shares is much greater. To be sure, economic data relating to current or recent past economic conditions remains very poor. US retail sales data indicates US consumers are still cutting back, gross domestic product (GDP) growth has fallen at an alarming rate and unemployment is still rising everywhere. However, a range of considerations provide confidence that an upturn in the economic cycle is moving into sight for later this year.

Firstly, governments worldwide have provided massive stimulus in the form of fiscal and monetary policy, as well as assistance for banks. They have also resisted the temptation to put up trade barriers. This is the opposite of what happened in the 1930s, making comparisons to the Great Depression increasingly meaningless.

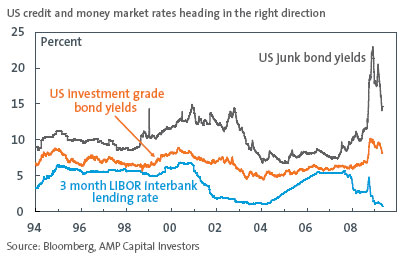

Secondly, there is increasing evidence that recent stimulus has gained traction in financial markets. Interbank lending rates have fallen to record lows, investment grade bond yields have fallen by 2% or more from last year’s highs and US junk bond yields have fallen from a peak of around 23% down to around 14%. Mortgage rates in the US, Australia and elsewhere have also fallen to generational lows and credit issuance has started to pick up. However, none of this is to say that credit markets are back to normal. In some areas credit markets remain very difficult, but they are moving in the right direction.

Reflecting this, yield curves have steepened significantly as short-term interest rates have fallen and long-term bond yields have risen. Historically, a steepening in yield curves precedes stronger economic growth by a year or so.

Thirdly, and most importantly, a range of forward looking economic indicators are showing an improvement:

- Consumer confidence in most countries is trending higher;

- Business confidence surveys in most countries appear to be improving;

- US home sales and business conditions for home builders seem to be bottoming; and

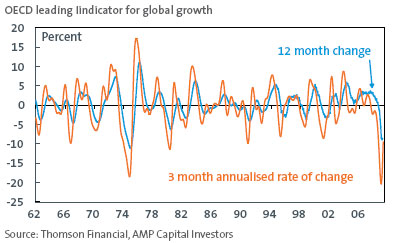

- The Organisation for Economic Cooperation and Development’s (OECD) global leading economic indicator appears to have lost downward momentum, with a rapid improvement in its three-month rate of change.

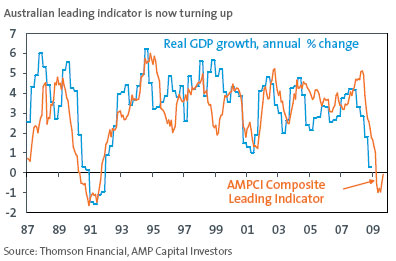

Our leading indicator for Australian economic growth seems to have bottomed over the last few months. While the leading indicator suggests the recession has further to go, its upturn is consistent with a recovery starting later this year. Rises in building approvals, consumer and business confidence and the yield curve have driven the Australian leading indicator higher.

While none of these indicators are confirming a recovery from later this year, improvements suggest a recovery is on track. Longer leading indicators, such as the steepening in yield curves, do point to a recovery six or nine months away.

How strong will the recovery be?

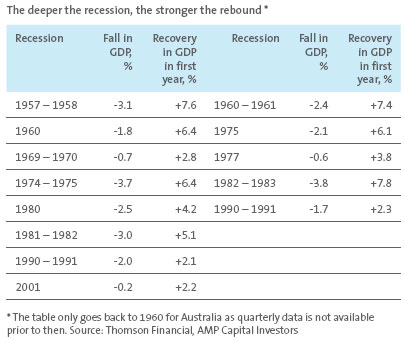

While there is increasing evidence that the recession is abating and reason for confidence in a recovery from later this year, there is much uncertainty regarding the strength of any recovery. The historical record tends to indicate that the deeper the recession the stronger the recovery. As the table below shows, US recessions with a 3% or greater fall in GDP have seen 5% plus rates of growth in the first year of recovery. In Australia, recessions deeper than a 2% slump have been followed by a 6% plus rebound.

* The table only goes back to 1960 for Australia as quarterly data is not available prior to then. Source: Thomson Financial, AMP Capital Investors

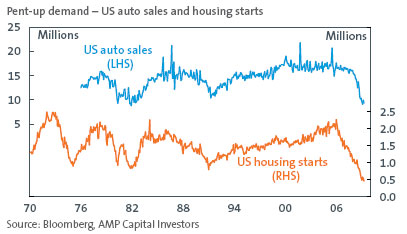

Since the latest recession will be rather deep in many countries, including the US (but to a lesser extent in Australia), history would suggest the possibility of a ‘Deep V’ style recovery. The logic is simple – the deeper the slump, the larger the cutback in inventories, the greater the level of pent-up demand and the greater the fiscal and monetary stimulus. A classic example of this was the early 1980s recession. The peak to trough fall in GDP was 3% in the US and 3.8% in Australia, yet GDP was up 5.1% in the US and 7.8% in Australia within a year of the recession ending. We know there has been a record stimulus this time and the slump in things like US housing starts and car sales indicates there will be a big build up in pent-up demand. At the very least, the latter suggests that there is plenty of scope for demand to spring back, beyond just an inventory cycle. Hence, for these reasons a ‘Deep V’ style economic rebound cannot be ruled out.

The most likely scenario though is that the first year of the recovery will be constrained. Recessions associated with financial crises and those that are globally synchronised tend to have slower recoveries, refecting tight credit conditions and continued deleveraging. According to an International Monetary Fund (IMF) study of recessions in the post war period, growth averaged 2.8% in the first year of recovery after synchronised recessions following financial crises, versus 4.3% for ’normal’ recessions. This was evident in the US and Australian recoveries from the early 1990s recession which was associated with a financial crisis. In the first 12 months of recovery from that recession US growth was just 2.1% and Australian growth was 2.3%. Interestingly, private sector credit in Australia actually contracted in the first year of recovery back then, which tells us that deleveraging or credit contraction won’t necessarily stop a recovery. However, the corporate deleveraging at the time did slow it, with many referring to it as a jobless recovery.

Another constraint on the recovery could be a shift from easy monetary and fiscal policy in the direction of tightening. Although, given the long lags involved this might simply result in a more volatile cycle going forward.

On balance, a constrained recovery seems most likely at least for the first year of recovery (i.e. next year). However, a ‘V-shaped’ rebound should not be ruled out.

Implications for share markets

We are still in recession and aftershocks from the financial crisis will be felt for a while yet. As such, periodic corrections and bouts of volatility are to be expected in share markets until the recovery actually arrives. In fact, the historical record in the US indicates that after a 37% rally (as we have seen since the March low to the recent high) there is a 70% chance of a 10% correction in the following six months. Capital raisings, further bank losses and rising unemployment generally have the potential to add to this likely volatility. However, with a range of indicators pointing to an economic recovery from later this year, shares still undervalued (our fair value estimate for the Australian share market is 4500) and near record levels of cash still sitting on the sidelines, the broad trend in shares is likely to remain up.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.