Will the gold rush continue?

Key points

- Gold has been about the best performing investment this year. It has been driven by a combination of collapsing interest rates, concern that monetisation will drive inflation, fear of the collapse of the global financial system and general investor caution.

- A retest of last year’s high of US$1032.7 an ounce looks very likely. In the short term, a period of volatility in the gold price is likely given that it has risen so far so quickly and everyone seems to be jumping into it (which is negative from a contrarian perspective). However, more upside is likely over the medium term.

Introduction

Through prehistoric to modern times, gold has been a source of fascination for mankind. Some see it as the only truly safe way to store wealth and that the decision to break the link between gold and paper currencies (i.e. the gold standard under which the price of gold was fixed in paper currencies) was the undoing of the global economic system. Others see it as a barbarous relic with no intrinsic value apart from that deriving from its appearance and hence its use in jewellery. Right now though, gold is attracting a lot of interest. It’s about the best performing ’asset’ so far this year; shares have continued to slide, government bonds have fallen in value as yields have increased and oil and other commodity prices have fallen. However, gold is up 10% in US dollars (US$) and is up 18% in Australian dollars (A$). Why all the interest and will it be sustained?

Gold over the long term

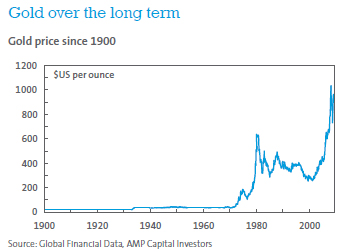

The chart below shows the price of gold since 1900.

Up until the early 1970s, the US$ was fixed against gold, albeit subject to periodic devaluations such as in 1934. From the early 1970s to 1980, gold was in a secular upswing as investors turned to gold for protection against inflation. However, from 1980 to 1999 the secular trend was down as inflation was brought under control. This decade has seen gold enter another secular upswing, much in line with other commodities. Last March, the gold price rose to a record high of US$1032.7 an ounce.

What is driving gold prices up?

Following last year’s record high, the gold price fell by over 30% to around US$700 an ounce as the US$ rebounded during the financial panic last October and the fear of deflation became dominant. Since then, despite further weakness in other commodity prices and share markets, the price of gold has rebounded, recently rising above US$1000 an ounce. Several considerations are behind the surging gold price and most suggest the price could go higher over the medium term:

- First, investors are fearful that all the policy stimulus - both fiscal and monetary - being pumped into the global economy will generate inflation. This would reduce the purchasing power of paper currencies (such as the US$, euro, A$ etc) which is why gold is in demand as a hedge against such an eventuality. Our view is that due to a massive slump in global demand and surging levels of excess capacity, deflation is a greater threat than inflation right now. However, if enough people are worried about inflation, it will certainly benefit gold.

- Second, while there are fears about the future of the US$, the outlook for other major currencies is not much better. Europe’s economy looks worse than the US economy and European banks are more highly leveraged than US banks; the strong yen looks unsustainable given the damage it has already caused the Japanese economy; and the renminbi is not really an option as it is not convertible. Hence, gold is seen as a good alternative to paper money.

- Third, some fear that fiscal and monetary policy stimulus will be ineffective and the end result will be a collapse in the financial system, against which gold is seen to provide a hedge.

- Fourth, the opportunity cost of holding gold as opposed to cash or government bonds as an alternative store of value has collapsed. US and Japanese interest rates are effectively zero, with other key regions looking like they will converge on that. As a result, the yield on cash is rapidly disappearing. Similarly, government bond yields have fallen dramatically and are now averaging 4% or less. With cash and bond yields falling towards zero, the missed return from holding a non-income producing asset such as gold (putting aside the potential yield achieved from rolling gold futures contracts over) is very low.

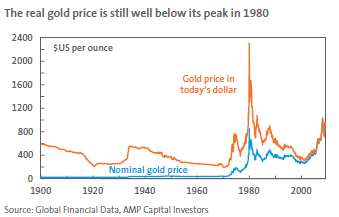

While gold has had a great run up over the last decade, it remains below its inflation adjusted peak in 1980 when gold was worth US$2306 an ounce in today’s prices.

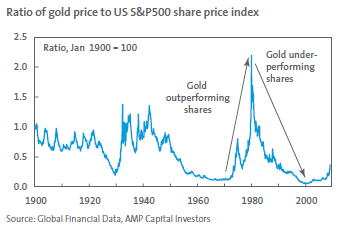

Finally, it is interesting to note that there is also something of a secular cycle in the relative performance of gold versus shares. The next chart shows the relative performance of gold versus the US S&P 500 share price index. Gold outperformed shares in the depression of the 1930s, underperformed during the post-war years, outperformed in the high inflation 1970s and underperformed shares during the equity bull market of the 1980s and 1990s. On the basis of this chart, gold may be in the early stages of a secular outperformance phase versus shares.

Some risk of short-term turbulence

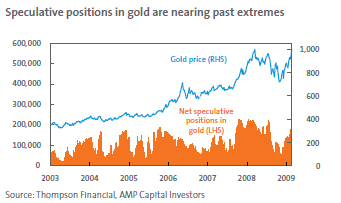

The one problem with gold is that it seems that right now everyone wants to buy into it. New flows into gold exchange traded funds (funds that track the price of gold) have exceeded that of all of 2008. Net speculative positions in gold are pushing up towards previous extremes.

From a contrarian perspective, this suggests there could well be a bout of short-term volatility or correction in the price of gold. However, it is unlikely to be enough to derail the positive forces referred to above.

Investing in gold

There are several things to note about investing in gold. Investors should realise that gold is highly speculative. It is not grounded by an income stream like most shares, property, bonds and cash. As such, there is no general agreement as to how it should be valued. Virtually all the gold that was ever produced still exists and can potentially come back on to the market. At the same time, actual production and demand for jewellery and industrial use is trivial relative to the huge gold stock. As a result, ‘animal spirits’ can play a huge role in determining its price. In fact, its value is really seen in terms of alternatives such as the outlook for paper currencies such as the US$. Also, the price of gold is correlated with other commodity prices to some degree. This can make for a volatile ride over time and suggests that gold should not be dominant in an investment portfolio.

There are numerous ways to get exposure to gold, all with their pros and cons:

- Buying physical gold, including coins and medallions. This quite clearly gives an exposure to gold but can be costly to store.

- Buying gold futures contracts. This avoids the physical storage problems and can be a way to leverage up one’s exposure, but might be seen as too complicated for many investors given the need to roll the futures contracts over as they near expiry.

- Investing in gold exchange traded funds which are funds traded on stock exchanges offering exposure to gold (and which are backed by physical gold or gold futures exposure). This approach is highly liquid.

- Investing in gold shares. These will reflect the movement in gold prices but are also affected by the performance of the individual companies which, in turn, may be influenced by other factors including production, new discoveries, currency moves and management.

- Various gold funds are offered by fund managers and others that provide an exposure to gold.

Concluding comments

While gold may be vulnerable to a short-term correction or bout of volatility, several considerations suggest that it may still have more upside on a medium-term view.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.