The turn in the cycle - the implications of falling interest rates

Key points

· The Reserve Bank of Australia (RBA) has kicked off an easing cycle with a 0.25% rate cut. While the RBA was circumspect about future moves, we expect soft economic conditions to result in more cuts, taking the cash rate to 6% in a years’ time.

· One rate cut will not see a sustained improvement in the economy or shares, but it is going in the right direction.

First interest rate cut in over 6 and a half years

For the first time since December 2001, the RBA has cut interest rates, taking the official cash rate from 7.25% to 7%. The recent run of economic data and anecdotal evidence suggests the significant slowdown in domestic demand the RBA has been looking for to slow inflation is underway. Without an easing in financial conditions, a hard landing, if not recession, looked increasingly likely. The statement announcing the cut was relatively circumspect about the prospect of more rate cuts and highlighted the balancing act between high inflation and weak overall demand growth. But the RBA has left the door open for further cuts and it is likely interest rates will fall further as sub-par growth adds to confidence that inflation will fall.

Rate cuts and the economy

Rate cuts are good news for the economy. The tightening in financial conditions as a result of 12 consecutive 0.25% increases in the official cash rate since May 2002; an additional 0.5% to 0.6% increase in bank lending rates on the back of the credit crunch; a 30% slump in the share market; falling house prices; the surge in petrol prices and an Australian dollar (A$) that was near parity significantly increased the risk of recession in the economy. The July tax cuts and budget goodies worth about $50 a week for a typical family were nice. However, they were more than offset by an extra $75 a week in interest payments since mid-2007 and an extra $20 a week in petrol bills faced by a key consumption-driving family with a $250,000 mortgage and two cars. The result has been an abrupt downturn in the economy, evident in a slump in consumer and business confidence (to recessionary levels), falling retail sales volumes in the March and June quarters, a slump in housing related indicators, a sharp slowing in credit growth and a softening job market. The list of companies announcing major layoffs has gone from a trickle to a torrent over the last couple of months. Companies include Holden, Ford, IAG, Qantas, Starbucks, Don KRC, NAB, Cadbury, Boeing, Fairfax, Babcock & Brown and Allco.

Fortunately, the RBA has seen the evidence and done an about face. However, there are several things to note.

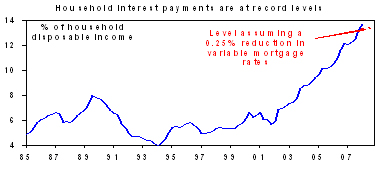

First, apart from an initial confidence boost, one rate cut on its own will not have a big impact. For a family with a $250,000 mortgage, a 0.25% interest rate cut amounts to a saving of $12 a week. This is a long way from reversing the extra $75 a week needed to service the mortgage since mortgage rates rose from 8.05% mid-2007 to just over 9.6% in July. Household interest payments relative to household disposable income will still be relatively close to record levels.

Source: Thomson Financial, AMP Capital Investors

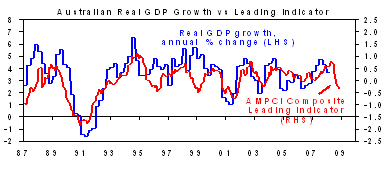

Second, the lag from rate cuts to the economy is long and variable, usually around 12 months or so. Given that the massive tightening in financial conditions over the last year is still working its way through the economy, it is likely that we will see a further deterioration in economic growth over the next six to 12 months or so. In fact, our leading indicator (based on building approvals, business and consumer confidence, the share market, the shape of the yield curve and money supply growth) is still falling.

Source: Thomson Financial, AMP Capital Investors

In addition, the worsening slump in the global economy suggests further downward pressure on commodity prices, which may start to soften the mining boom in the short term. Specifically, Europe and Japan reported negative growth in the June quarter, the US remains very weak and Asian countries (including China and India) have started to slow. It is also notable that rate cuts have not yet prevented economic slumps in the US, UK and Canada.

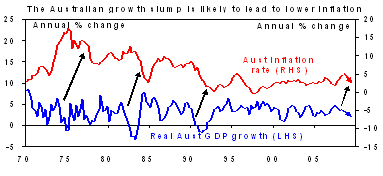

This suggests more rate cuts are likely. But what about inflation? The slump in growth suggests inflation will fall and this will be helped by the falling oil price. With growth likely to remain sub-par and inflation likely to fall over the year ahead, our assessment is that the cash rate will fall to around 6% over the next 12 months.

Source: Thomson Financial, AMP Capital Investors

Applying the normal lag and assuming more rate cuts, the commencement of an easing cycle should help Australia’s growth rate to improve from around mid-2009.

Finally, without a cut in bank lending rates, RBA rate cuts are academic so it is good to see the major banks immediately cutting their mortgage rates by 0.25%. While it is unclear how they will respond to subsequent RBA rate cuts, bank funding cost have been falling and it is worth noting the RBA can just keep cutting the cash rate until it gets the mortgage rate it feels is appropriate.

Lower interest rates and the housing market

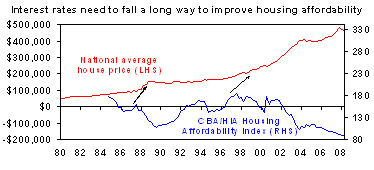

The move to lower interest rates coming into the spring home-buying season may see the housing market perk up a bit in the next month or so. However, this is likely to be temporary as a range of factors point to continued tough conditions. First, housing affordability remains terrible and it will take several mortgage rate cuts and a decent decline in house prices to produce any significant improvement.

Source: REIA, CBA/HIA, AMP Capital Investors

The house price booms of the late 1980s and mid-1990s to 2004 began with much higher levels of housing affordability. Second, Australian house prices remain very overvalued relative to rents and average household income levels. Third, the downturn in the economy is likely to result in rising unemployment over the year ahead. This is likely to see increased uncertainty which will largely offset the initial impact of lower interest rates and keep buyers sidelined for a while. On top of this, the ongoing credit crunch is likely to mean the availability of mortgage credit will remain constrained. For these reasons, the housing market is likely to remain weak in the year ahead. Importantly though, the shortage of houses relative to underlying demand is likely to prevent a US-style collapse in house prices.

What do lower interest rates mean for shares?

Falling interest rates are normally good for shares because they help future profit growth and make shares more attractive (compared to cash). The table below shows the Australian share market’s response after the first rate cut at the start of an easing cycle.

Australian equity performance (ASX 200), %change, months after first RBA rate cut in an easing cycle

First rate cut +3mths +6mths +12mths May 82 -7.6 1.0 19.8 Jan 86 12.7 17.6 45.7 Jan 90 -10.9 -3.8 -23.9 July 96 6.5 11.1 23.4 Feb 01 0.5 2.6 3.8 Average 0.2 5.7 13.8

Recessions for the Australian economy are highlighted in red. Source: Thomson Financial, AMP Capital Investor

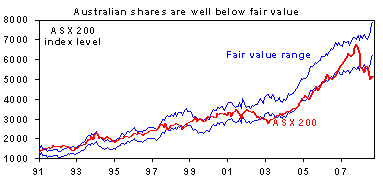

On average, shares are up 3, 6 and 12 months after the start of rate cutting cycles. But the experience is mixed in times of recession. However, shares have already fallen sharply and look very cheap (see the next chart – which shows a recent improvement in fair value due to the fall in bond yields) and strong resource sector profits are likely to underpin overall profit levels. Hence, there is good reason to believe shares will be up on a 12-month horizon.

Source: Thomson Financial, AMP Capital Investors

However, news flow is likely to remain poor over the next few months with more earnings downgrades, more bank provisioning for bad debts and more bad global news. So the ride is likely to remain rough for a few months yet. But with interest rates falling, there is reason to be more confident about the 12-month outlook.

What about the Australian dollar?

While the A$ has the potential to bounce back to around US$0.90 after its sharp fall, the cyclical trend is now down. The combination of falling Australian interest rates and a correction in commodity prices suggests the A$ has more downside ahead over the next 6 months or so, possibly to around US$0.80. However, the long-term trend is likely to remain up on the commodity super cycle.

Conclusion

One interest rate cut on its own will not necessarily lead to a sustained improvement in the economy or shares. But it is a move in the right direction and suggests there is light at the end of the tunnel.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors