China starts to unwind some of the stimulus

Key points

- China has embarked on monetary tightening and, with the economy growing strongly and worries that imbalances will build, further tightening is likely.

- However, although this will likely cause bouts of volatility in Chinese shares and global financial markets, China is a long way from undertaking a draconian tightening designed to limit growth. We continue to expect Chinese gross domestic product (GDP) growth of around 10% this year.

- As a result, Chinese tightening is unlikely to threaten the rising trend in shares this year. However it will, along with tightening elsewhere, result in a more volatile ride.

China moves to tighten

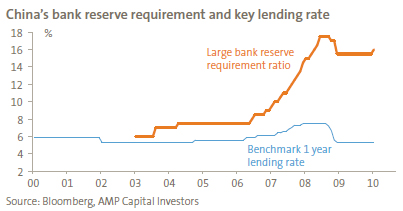

China has confirmed that 2010 will not be all smooth sailing by kicking off a monetary tightening cycle, increasing bank reserve requirements (from 15.5% to 16% for large banks). This follows the People’s Bank of China signalling a change in its monetary policy stance in the September quarter last year, the adoption of a lower credit growth target for 2010 (down from around 32% in 2009), moves to tighten up lending and investment in sectors deemed to be in oversupply and an increase in bill rates in the last week.

So far, China hasn’t raised its key one-year lending rate, but with the economy likely to remain strong, and with moves in the reserve ratio leading the lending rate in the last tightening cycle, it’s likely the lending rate will start to increase in the months ahead.

China’s bank reserve ratio requirement hike has caused some volatility in share markets and other growth assets following concerns that China’s withdrawal of liquidity will harm the Chinese and global economic recoveries. As we have indicated elsewhere, the withdrawal of the stimulus put in place to combat the global financial crisis will be a major issue for markets in 2010 and China’s move confirms this. This note looks at the key issues.

Starting to wind back the stimulus makes sense

Monetary tightening in China makes sense. Both fiscal and monetary policies were eased dramatically in late 2008 to combat the global financial crisis. All the evidence suggests this has been successful:

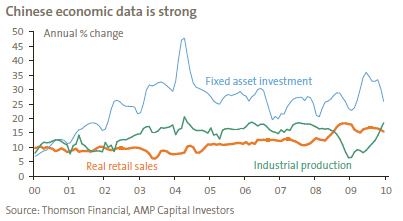

- Money supply and loan growth has surged;

- Fixed asset investment is very strong;

- Industrial production is growing at around pre-crisis rates;

- Real retail sales growth has remained strong;

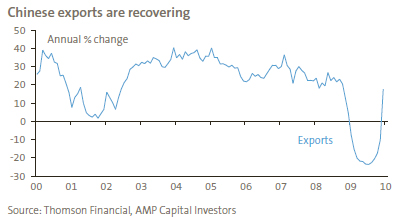

- Exports are up 17.7% over the year to December;

- Home sales are up 167% year on year;

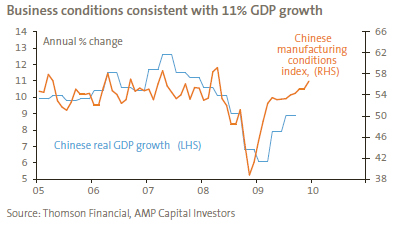

- Surveys of business conditions in manufacturing have returned to pre-crisis levels; and

- GDP figures to be released next week are likely to show growth over the year to the December quarter 2009 of around 11%.

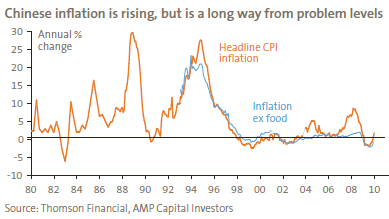

On top of this, concerns about imbalances are starting to build. Inflation is now positive again and strong money supply growth points to a further rise ahead. There are also reports of bottleneck constraints in natural gas supply and public transport. Additionally, house prices are up 5.7% over the year to November (and more in some cities, e.g. up 14% in Shenzhen) and some observers are pointing to the doubling of the share market from its November 2008 low to August last year.

So, with growth back to pre-crisis levels and concerns about bottlenecks and asset bubbles, it makes sense to start removing the policy stimulus in China. More moves are likely with further increases in the required reserve ratio, several 0.27% increases in the benchmark one-year lending rate, a resumption of the revaluation of the Renminbi against the US dollar this year (probably by 5-7% or so) and the use of administrative directives to wind back lending and investment in certain areas.

But policy is normalising, not becoming tight

Although further tightening moves are likely in China, and this will no doubt cause bouts of uncertainty in share markets, this should be seen as a move back to normality rather than a move to tight policy. There are several reasons for not expecting the adoption of draconian policy tightening at this stage.

First, while inflation is likely to rise, most of the current uptick is due to food and energy prices. Core inflation remains negative and is likely to remain low given excess capacity in major industries. The current situation is radically different to the 25% to 30% inflation rates of the late 1980s and mid 1990s when China suffered from a shortage of productive capacity. In short, inflation will rise but not by enough to justify draconian monetary tightening.

Second, while the Chinese property market is very hot in some cities, national property price growth of 5.7% over the last year is actually quite modest given nominal growth in the economy of around 13%.

Third, Chinese authorities have said repeatedly they are continuing to target strong growth in 2010 and tightening will not be aggressive. While the official growth target will probably be around 8% (as it seems to be every year) they will likely be happy with growth around 10%. Pressure to ensure enough jobs for the 15 million people migrating to the cities every year remains intense.

So Chinese moves to start unwinding the stimulus don’t threaten continued strong growth in China this year. Rather they should be seen as a good sign, because moving to head off overheating, inflation and other imbalances in the economy before they get out of hand will ensure the recovery will be longer and more durable. We continue to expect Chinese growth this year of around 10% on the back of strong consumer spending, robust growth in investment (albeit slower than over the last year) and a rebound in exports.

Finally, talk that China’s massive stimulus has put its economy at risk of collapse is nonsense. The government’s budget deficit is below 3% of GDP and public debt is only around 20% of GDP. Also, despite the surge in bank lending, banks are in reasonable shape with the loan to deposit ratio near a record low and a non-performing loan ratio of just 2% (compared with 24% back in 2000). Corporate gearing is low and household debt is around 15% of GDP, compared with 100% in the US and Australia. In the property market, average deposits are around 30% of values and around 20% of buyers pay in cash – a situation which is radically less bubbly than that which prevailed in US, UK and Australian property markets a few years ago.

Implications for equity markets

Quite clearly, the uncertainty and reality of further tightening will constrain the Chinese share market and result in bouts of weakness – as it has since last August. However, with the Chinese economy likely to grow 10% this year, profit growth expected to be strong and the price to earnings multiple of 35 times only just above its long-term average, further gains in Chinese shares are likely in the year ahead, albeit at a more constrained pace than in 2009. Note also that while Chinese shares are well up from their low in November 2008 they are also still down 47% from their October 2007 high.

Similarly, further Chinese tightening is likely to result in bouts of volatility and weakness in global shares, Australian shares and commodity prices going forward. However, with China’s tightening unlikely to become draconian and Chinese growth likely to be around 10% this year, it probably won’t be enough to upset the broad rising trend in global shares and other growth assets. Note that Chinese monetary policy was tightened right through 2003 to 2007, causing occasional bouts of volatility, but not preventing the prevailing bull market in shares and other growth assets globally. It was only after about four years that tightening ended up going a bit too far, and even then this was largely because it was combined with the onset of the global financial crisis.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.