Market update - March 2007

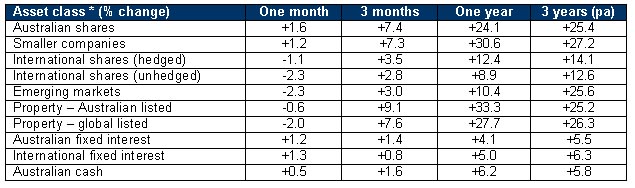

The table below provides details of the movement in average investment returns from various asset classes for the period up to February 28, 2007.

Australian shares remain in positive territory

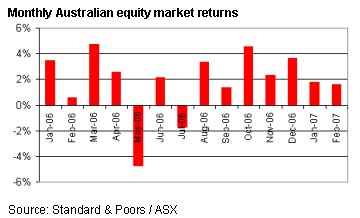

Despite a late month sell-off, the Australian equity market still finished February 1.6% above its opening. Growth had been significantly more positive earlier in the month. However, a 10% drop in prices on Chinese stock markets triggered a global sell-off that saw prices in Australia and most other major markets fall by around 3%.

The Chinese-related fall did follow a generally positive profit reporting season in Australia. Overall, earnings of reporting companies were around 20% higher than at the same time last year, with resource companies continuing to post the strongest growth. There were, however, a few disappointments with Allco Finance, Tabcorp and Toll Holdings all being sold down by the market over February.

Smaller companies also finished the month in positive territory, with the smaller companies index rising 1.2% over February. This performance continues a stellar run for the smaller end of the market. Over the past 6 months, both small and mid range shares have increased in value by around 21%. This is well above the 15% growth recorded by the top 150 companies.

International shares weaker

Without the same early month momentum as Australian shares, the late February sell-off saw most major markets finish lower last month. The overall MSCI World Index (with the currency position hedged) fell by 1.1%. A slight firming of the Australian dollar meant that the unhedged MSCI World Index experienced a larger decline of 2.3%.

In addition to the price decline in China, market concern over the State of the United States (US) economy heightened over February, with a particular focus on the quality of loans held by certain US financial institutions. Nonetheless, profit reporting by US companies for the December quarter was generally strong, and this helped restrict the overall decline in the S&P 500 Index to just 2.2%.

Although also being impacted by the Chinese sell-off, the strengthening Japanese economy encouraged investors and allowed the Nikkei Index to finish February 1.3% ahead. After some weakness in mid 2006, the Japanese market has returned to be one of the better performed developed markets, adding 9.1% over the last 6 months.

Despite being somewhat more insulated from the effects of the China, European markets closed the month slightly lower. The British FTSE Index was down 0.5%, whilst the German DAX slipped 1.1%. The European market continues to be cautious in its outlook with the average price earnings ratio of around 12 making it look particularly cheap – on paper at least.

Interest rates steady

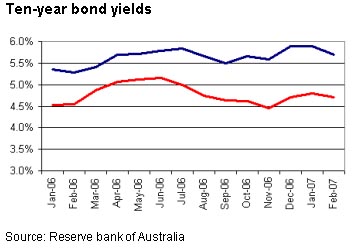

Once again, Australia’s Reserve Bank decided to leave cash interest rates unchanged at 6.25% last month.

Longer-term bond yields did, however, fall slightly and this created positive returns for fixed interest investors. The fall in Government bond yields was led by the US, where concerns over the lending quality of various financial intermediaries saw a “flight to quality”, resulting in a bidding up of bond prices.

Ten-year Government bonds in Australia are now yielding 5.7%, now over half a percentage point below the cash interest rate. This margin is similar to the position in the US where the 10-year Government bond is yielding 4.7%, compared to an overnight cash interest rate of 5.25%.

Property weakens slightly

Both local and global listed property prices weakened over February. The Australian listed property index was 0.6% lower, the first fall since May last year. This fall came despite a 9% spike in the price of Centro Properties Group. A 3% drop in the price of retail giant Westfield was the major contributor to the sector’s decline. Internationally, listed prices were 2% lower, but remain 28% ahead year on year.