Review of 2009 and outlook for 2010

Key points

- 2009 has been a year of recovery. First in share markets and then in global economic activity. While unlisted assets have remained under pressure, they always lag and now look to be bottoming. Patient investors have seen some recovery in their wealth after the losses of 2008.

- 2010 is likely to see the economic recovery continue and become self sustaining. This will underpin gains in most growth-oriented investments.

- However, with uncertainties about the strength of the recovery lingering and key central banks moving towards monetary tightening in the year ahead, share markets will be more volatile and gains more constrained than has been the case since March.

2009 has been a year of recovery

At the start of 2009, fear of a complete financial meltdown was rife. There was doubt as to whether the massive and unrelenting stimulus and financial rescue efforts put in place around the world would work, and many were talking of a re-run of the Great Depression. As a result, share markets and other assets continued to plunge in March.

However, the key message from governments and central banks in most countries was that they would do whatever it took to head off depression and restore asset prices. Budget deficits in some countries were pushed up to 10% of GDP and several central banks moved beyond near zero interest rates to embark on ’quantitative easing‘.

And it worked! Just when it seemed that all hope was lost, the gloom began to lift in March. Shares bottomed, credit markets unseized, commodity prices started to rebound, bank losses started to recede and the ’green shoots‘ of economic recovery started to pop up. Talk of a false rebound was common. However, as the green shoots turned into saplings and the recovery in share markets continued, it became apparent that the massive worldwide economic stimulus had traction.

But while growth has rebounded, underlying inflation pressures have continued to slide reflecting the massive amount of global spare capacity. As always, inflation is a lagging indicator. Similarly, unemployment and private sector credit are also lagging indicators. Unemployment has increased to around 10% in the US and Europe, although there are signs that it is close to topping.

Perhaps the biggest surprise over the last year has been the Australian economy. It has managed to avoid recession and then has had a surge in unemployment, despite widespread fears to the contrary. Australia is about the only advanced country to have had positive GDP growth over the last year. This can be attributed to solid export demand, a sound financial system and the rapid and massive economic stimulus. Australia has yet again proved itself to be the ‘lucky country’. Reflecting this, the RBA has been one of the first central banks to start raising interest rates.

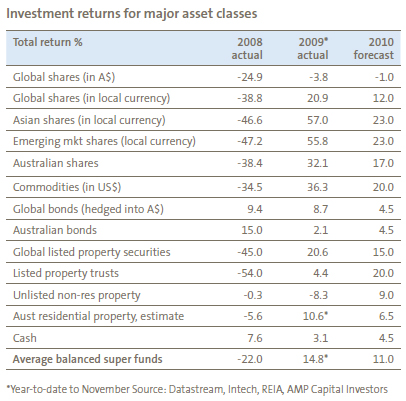

Emulating the growth rebound, listed growth assets have rebounded in value, as shown in the following table:

- The key winners over the last year have been Asian and emerging markets generally (with gains of around 55%), commodity prices (with metal prices up 80% and gold up 30%), Australian shares and corporate debt.

- Global shares have increased in local currency terms. However, for Australian investors the gains have been wiped out by a sharp rise in the value of the Australian dollar (A$).

- Cash and government bonds have been poor performers, with the latter dragged down by a rise in yields from low levels as fears have subsided.

- After holding up reasonably well in 2008, unlisted property returns fell sharply in a lagged response to credit problems and the collapse in share markets.

- By contrast, Australian housing saw positive returns in response to the first home owners boost, the earlier collapse in mortgage rates and the boost to confidence.

As shares are the dominant investment in most super funds, this all translated into a recovery for investors.

The key lessons of the last year were that counter cyclical macro economic policy measures do work, that just as the cycle goes down it also goes up, and that markets always bottom just at the point of maximum gloom.

Outlook for 2010

In direct contrast to the doom and gloom of a year ago, the outlook for 2010 is reasonably bright. Sure, the aftershocks from the global financial crisis – such as high unemployment, periodic debt blow-ups (Dubai, Greece, etc) and constrained bank lending – will linger. But as 2010 progresses, the global recovery is likely to become increasingly self sustaining. In this regard the key themes of relevance for investors for 2010 are likely to be:

- A self sustaining economic recovery. Leading economic indicators point to continued growth over the year ahead. But most importantly, signs that labour markets are starting to turn the corner – notably in the US – suggest the recovery is on its way to becoming self sustaining. In other words, fiscal and monetary policy has primed the pump and the private sector will now take over. 2010 is likely to see global growth of around 4% (up from 0.8% in 2009, which primarily reflects the late 2008/early 2009 slump).

- Stronger growth in the emerging world. Thanks to stronger domestic demand and less in the way of structural constraints such as debt and demographics, growth in the emerging world is likely to be 7% compared to around 2.5% in advanced countries in 2010. China is likely to grow by 10%, India by 8% and Brazil by 6%.

- Benign inflation. Inflation lags economic activity because it reflects capacity utilisation, which is below normal well into an economic recovery. This time is no different except that excess capacity is greater than normal, with the result that underlying inflation is likely to continue to fall in the year ahead.

- A gradual move to wind back the stimulus. Along with the economic recovery there will eventually be pressure to wind back budget deficits and raise interest rates. Talk of higher interest rates and uncertainty about how aggressive the wind back will be, will no doubt fuel occasional corrections in asset markets over the year ahead, particularly in those markets that have benefitted the most from low US interest rates. Namely, emerging markets, commodities and commodity currencies – much as occurred in 2004 when the Federal Reserve (the Fed) last moved to tighten. However, tightening will be a very slow process in advanced countries, given memories of premature tightening in the US in the 1930s, still very high unemployment, and falling underlying inflation. Global central banks will first move to unwind the liquidity stimulus before starting to raise interest rates during the second half of 2010. Interest rates will still be very low by the end of 2010 – maybe around 1.5% in the US. China is likely to move a bit more aggressively to tighten, but it is not as dependent on stimulus measures.

- Earnings recovery. As the economic recovery becomes entrenched, earnings growth will return and take over as the key driver of share market gains. Profit growth is likely to be in the order of 20% in the US and Australia, and 30% or more in emerging countries.

- Australian economic growth to rebound but underlying inflation to slow. The rebound in business and consumer confidence, a housing construction recovery, numerous mining projects, and increased public infrastructure spending are expected to underpin GDP growth of around 4% though 2010. This is likely to see unemployment return to around 5.5% by year-end. Inflation is likely to be 2.5% thanks to a combination of global excess capacity and the impact of the strong A$. While the Reserve Bank of Australia (RBA) will continue to raise the cash rate, the process is likely to be gradual, taking it to around 4.75% to 5% by year-end, with low inflation and additional increases in bank lending rates stopping a more aggressive rise.

Looking at the major asset classes for the year ahead:

- Share markets are likely to rise further, thanks to the combination of improving economic and profit growth, low inflation and sustained low interest rates at time when there is still plenty of cash on the sideline. However, shares are moving from a multiple driven phase to an earnings driven phase. This, along with moves towards higher interest rates, will likely result in more volatile and constrained gains than has been the case since March. The Australian ASX 200 and All Ords indices are expected to rise to around 5600 by the end of 2010 and we see Australian shares continuing to outperform traditional global shares, reflecting their higher dividend yields and stronger growth prospects.

- Asian and emerging markets are likely to remain out performers reflecting better growth prospects. However, the ride will be more volatile.

- Commodity prices and the A$ are likely to remain solid off the back of the economic recovery, with the A$ breaching parity. However, expect occasional sharp corrections when the Fed moves towards tightening.

- Cash remains unattractive, reflecting low interest rates. Cash returns are likely to be around 4.5%.

- Government bond yields are likely to push higher later in the year as monetary tightening starts to be factored in. Corporate debt is far more attractive with yields of 7.5% or more.

- Unlisted non-residential property is likely to see positive returns on the back of yields of around 7% and modest capital growth. This is thanks to more favourable space demand/supply fundamentals, less selling pressure and increased investor demand.

- Average house price gains are likely to slow as mortgage rates rise and the first home owners boost comes to an end. A stronger labour market will provide some support though. Overall, expect average house price gains of around 5%.

Our return expectations imply that most super funds should see continued gains through 2010.

US consumers and premature tightening are the main risks

The two big risks are that US consumers return to cutting spending and paying down debt and/or that policy makers start tightening too aggressively, too early. However, a stronger labour market should help US consumers. It also seems that policy makers are keen to avoid a re-run of Japan in the 1990s and the US in the 1930s, when policy was tightened too aggressively. China is also worth watching.

Conclusion

The last year has told us that just as the investment cycle goes down, it also goes up. Right now, it is still early days in the upswing and so growth assets, like shares, are likely to continue to do well over the year ahead.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital Investors